BRIDGETOWN, Barbados – Caribbean Community (CARICOM) leaders were on Wednesday meeting with a delegation from the United States House Committee on Financial Service aimed at reversing the damage caused by decades of loss of corresponding banking, de-risking and deteriorating financial access.

Congresswoman Maxine Waters addressing Caribbean Financial Access Roundtable (CMC Photo)Congresswoman, Maxine Waters, who chairs the Committee, said that the meeting which is also being attended by bankers and other stakeholders, that as a framework is advanced “that we cultivate in the Caribbean (it) could become a model for other regions around the world facing similar obstacles to financial access.

Congresswoman Maxine Waters addressing Caribbean Financial Access Roundtable (CMC Photo)Congresswoman, Maxine Waters, who chairs the Committee, said that the meeting which is also being attended by bankers and other stakeholders, that as a framework is advanced “that we cultivate in the Caribbean (it) could become a model for other regions around the world facing similar obstacles to financial access.

“I welcome a robust discussion on the cause of de-risking as well as the negative effects to the financial access to the people and the region. These are the reasons that we cannot choose talk over action,” she told the opening ceremony.

Waters, who together with Barbados Prime Minister Mia Mottley, is co-chairing the “The Roundtable Discussion on De-Risking and Correspondent Banking” said while over the years there have been improvements in the situation “especially as many of the Caribbean nations have been active with significant financial crimes compliance measures yet despite these efforts…to reform many Caribbean nations continue to face considerable challenges in accessing financial services.”

She said instead of accepting financial exclusion “we must work together to find ways to increase financial connections including correspondent banking services to and from the Caribbean”.

She said she would continue to focus on what can be done to improve the situation in Washington to support the Caribbean including bringing together key stake holders to finding solutions to the issue of financial access.

“I am pleased to report I have made progress in raising the issue profile in Washington and highlighting its urgency,” the Congresswoman said, noting her role in the passage of legislation “that is moving the US government to a tangible solution”. Barbados Prime Minister Mia Mottley (CMC Photo)

Barbados Prime Minister Mia Mottley (CMC Photo)

Earlier, Prime Minister Mottley warned the developed countries of adopting a one size fit all approach towards the situation.

“Because to do so would be to put on small states prohibitive burdens and that the appropriate measure should be that regulation should be appropriate to risk. That whatever the nature of the risk we need to assess it and we need to ensure that our regulation meets that risk”.

Mottley said it is against this backdrop that she is re-stating the region’s position and “we are unflinching in our support for efforts internationally to stop terrorism, to stop crime, to stop the financing of both of them.

“And that has made us unpopular among those who believe that money laundering and know your customer rules are backward and repressive. It has, but the current regime, we believe of anti-money laundering and countering financing of terrorism is so transparently flawed that it is likely to end up being counter-productive, inadvertently supporting crime and the sponsorship of financing for crime”.

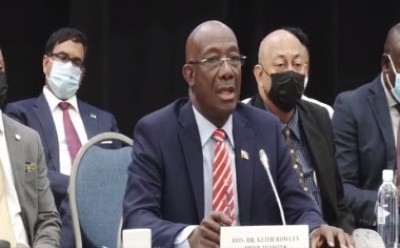

Trinidad and Tobago Prime Minister Dr. Keith Rowley (CMC Photo)Mottley said that the countries routinely on the anti-money laundering list have relatively very little international finance of any sort and that the countries that have never been listed “and will never be listed are where most international financing regrettably takes place.

Trinidad and Tobago Prime Minister Dr. Keith Rowley (CMC Photo)Mottley said that the countries routinely on the anti-money laundering list have relatively very little international finance of any sort and that the countries that have never been listed “and will never be listed are where most international financing regrettably takes place.

“The rich countries develop and drive the list. Those countries do not appear on the list and criminal can see and follow who do not appear on the list and it doesn’t take a Solomon to know which and where is the path of easiest resistance”.

She said that the truth is from the bursting of money laundering, everyone knows that transactions are routed through major European countries as well as Canada and the United States and “we do not hear any of these centers being sanctioned, nor do they face the spectacle of enhanced due diligence.

She said the sanctioned countries including those in the Caribbean do not have the capacity to distort the global system.

“And that’s why we say that regulation must be appropriate to risk. At the end of the day when we do these things there is a flawed and discriminatory outcome that is a result of a process that is not based around actually finding money laundering or identifying critical elements that money launderers require…but yet we are having to restructure our laws and processes to ensure that all beneficial ownership is disclosed to everyone”.

Trinidad and Tobago Prime Minister Dr. Keith Rowley said existing regulations were such that even a reputable attorney had found it difficult to open a banking account.

Rowley said that the region’s call is one not only of fairness “but one of survival.

“Decisions taken away from us, outside of our region, saw us losing the production of bananas for a livelihood, sugar for a livelihood and we are encouraged every day to diversify our economies,” Rowley said, noting that one area of success for the region has been in the international financial services”.

He made reference to the success of the Trinidad-based banks, Republic Bank and First Citizens Bank “which has shown that indigenous banking could grow and provides the people of our region and area of economic activity which could be safe and productive for us.

“And we have been doing that,” he said, noting that he received “good news” on Wednesday that a business which “we have been trying to give birth to in Ghana has come our way with one of the first major contracts.

“Our Trinidad bank in Ghana is representative of how financial services can bring about good processes for us,” he said, reiterating earlier statements by Prime Minister Mottley “represent all our interests and our understanding of the situation”, arbitrary, self-serving action from the developed world seeking to say as we interpret it that you may enter, but don’t go too far.

“That’s what they are saying to us in the banking business and banking is something that we can do, something that we must be allowed to do and it represents successful diversification of the economies in the Caribbean,” Rowley added.